Leveraging Deemed Accounts for Streamlined Collateral Management

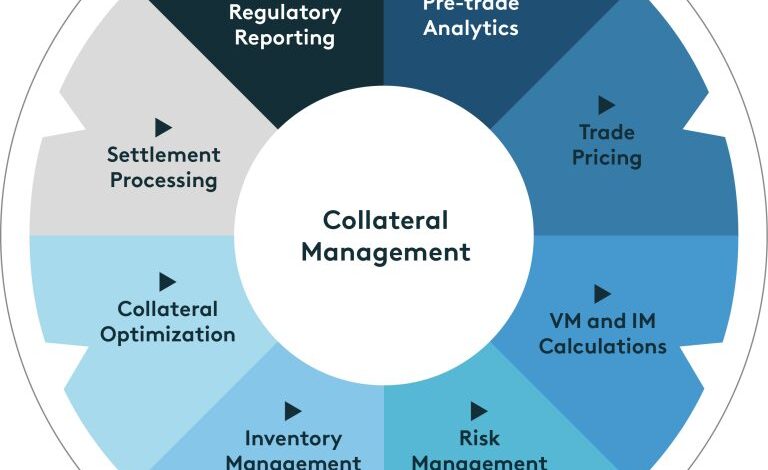

In the fast-paced world of finance, collateral management plays a crucial role in securing loans, facilitating trades, and managing risks. Among the various tools available for collateral management, deemed accounts stand out as a convenient and efficient option, offering investors a streamlined approach to managing their securities portfolio. In this article, we will explore the concept of deemed accounts and how they can be leveraged for effective collateral management, with a focus on understanding their relevance to the dynamic fluctuations in IRCTC share price.

Understanding Deemed Accounts:

A deemed account, within the realm of dematerialized (demat) accounts, refers to an account automatically created by depository participants (DPs) to facilitate the conversion of physical securities into electronic form. This conversion process is essential for investors looking to streamline their collateral management process and eliminate the complexities associated with physical share certificates.

Benefits of Deemed Accounts for Collateral Management:

Deemed accounts offer several benefits for collateral management, including:

High Security: By storing securities in electronic form, deemed accounts enhance the security of collateral assets, mitigating the risk of loss, theft, or damage associated with physical certificates while considering about the IRCTC share price.

Good Accessibility: Deemed accounts provide investors with easy access to their collateral holdings, allowing for swift and efficient monitoring and management of collateral assets.

Real-time Monitoring: With deemed accounts, investors can monitor the value of their collateral holdings in real-time, enabling proactive risk management and decision-making.

Higher Efficiency: Deemed accounts streamline the collateral management process by eliminating the need for physical paperwork and manual record-keeping, thereby reducing administrative burdens and operational costs with the help of knowing IRCTC share price.

Greater Flexibility: Deemed accounts offer investors the flexibility to manage their collateral assets remotely, through online platforms and mobile applications, ensuring convenience and accessibility.

Relevance to IRCTC Share Price:

As we discuss the benefits of deemed accounts for collateral management, it’s essential to consider their relevance in the context of specific stocks, such as IRCTC. As a leading player in the Indian railway and hospitality sectors, IRCTC shares hold significant value as collateral assets. Monitoring IRCTC share price movements and managing collateral positions require a reliable and efficient platform, which deemed accounts provide.

Investors holding IRCTC shares in electronic form through deemed account can effectively manage their collateral positions, leveraging real-time access to market information and seamless transaction capabilities. Whether pledging IRCTC shares with competitive IRCTC share price as collateral for loans or margin trading, deemed accounts empower investors to navigate collateral management with ease and confidence, optimizing their investment strategies.

Thus in the end,

Deemed accounts offer investors a streamlined and efficient approach to collateral management, enhancing the security, accessibility, and efficiency of managing collateral assets. With their relevance to stocks like IRCTC, deemed accounts serve as a valuable tool for investors looking to leverage their securities holdings for various financial purposes. By harnessing the power of deemed accounts, investors can optimize their collateral management strategies and unlock new opportunities in the dynamic world of finance.